Negotiations Surging as U.S. Government Considers Stake in Intel, Provoking Share Price Surge

Recent reports indicate that the U.S. government may be negotiating to purchase a stake in Intel, leading to a notable spike in the company's share price.

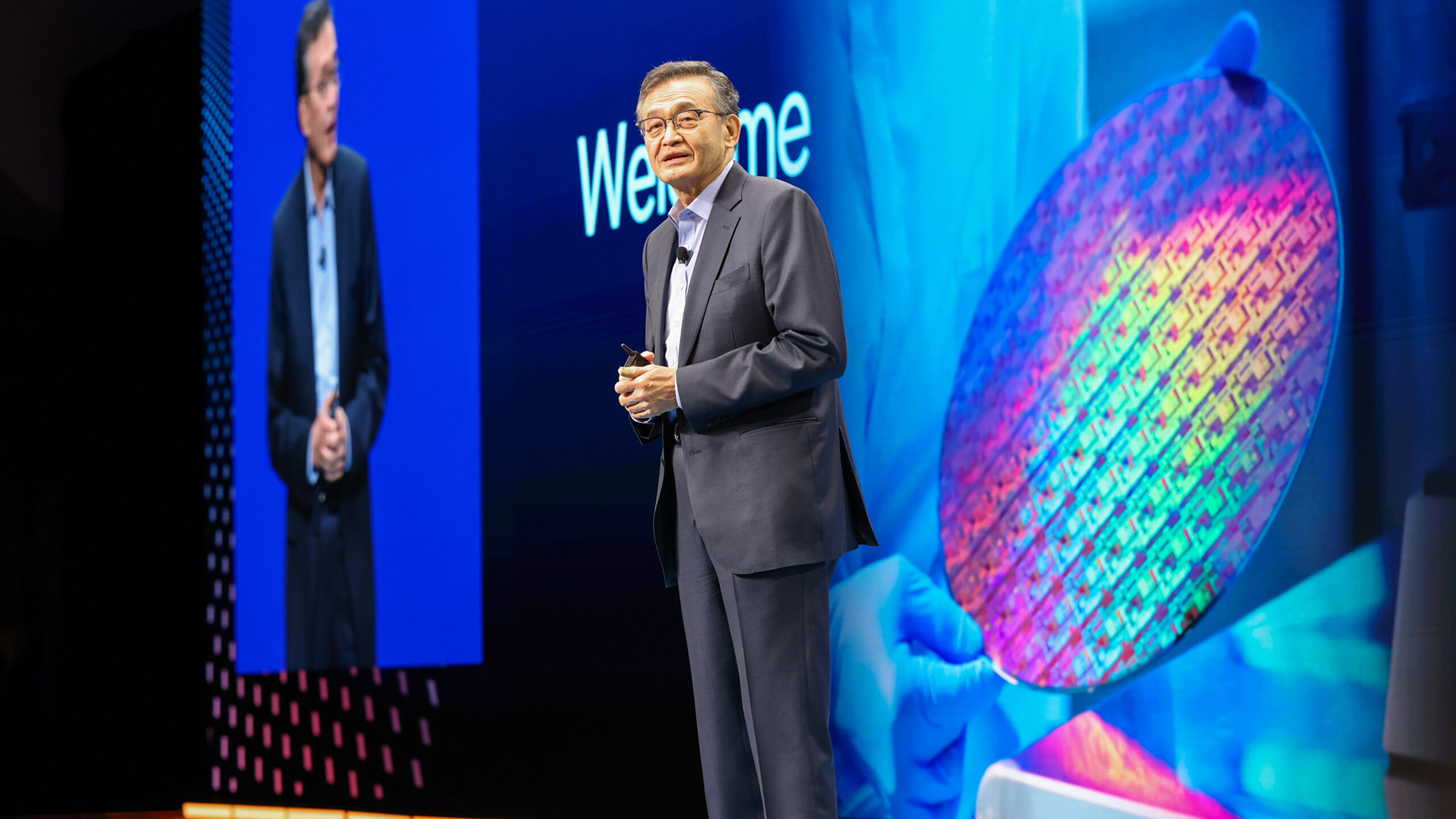

The situation surrounding Intel has shifted dramatically over the past weeks. President Trump previously demanded the resignation of the company’s new CEO, Lip-Bu Tan, criticizing his leadership. However, after a positive face-to-face meeting, Trump changed his tune, now lauding Tan’s efforts.

Bloomberg has reported that the Trump administration is in discussions to acquire a stake in Intel, which has resulted in the company’s share price increasing by 7%. Sources suggest that this interest arose from the aforementioned meeting, indicating that Trump’s administration may deploy government funds to acquire this stake. Though no agreement has been finalized, this represents a significant turnaround from Trump’s earlier views, where he deemed Tan as “highly conflicted” due to Intel’s ties to Chinese organizations.

Intel’s rising share price, a 7% increase last Thursday, reflects optimism over potential government involvement, a move that has sparked prior discussions but remained unfulfilled until now. The administration’s primary goal appears to be supporting domestic chip manufacturing against the backdrop of intensifying Taiwanese competition.

Despite a challenging 2024, where the company grappled with leadership changes and strategic missteps, the current dynamics unveil a crucial juncture for Intel, as the rapidly evolving talks may serve to bolster the U.S. chip industry while stabilizing Intel’s long-term future.