Intel is set to sell its 51% stake in Altera, a company specializing in programmable logic devices, to the investment firm Silver Lake. This deal aligns with Intel’s push to focus more on its core business areas.

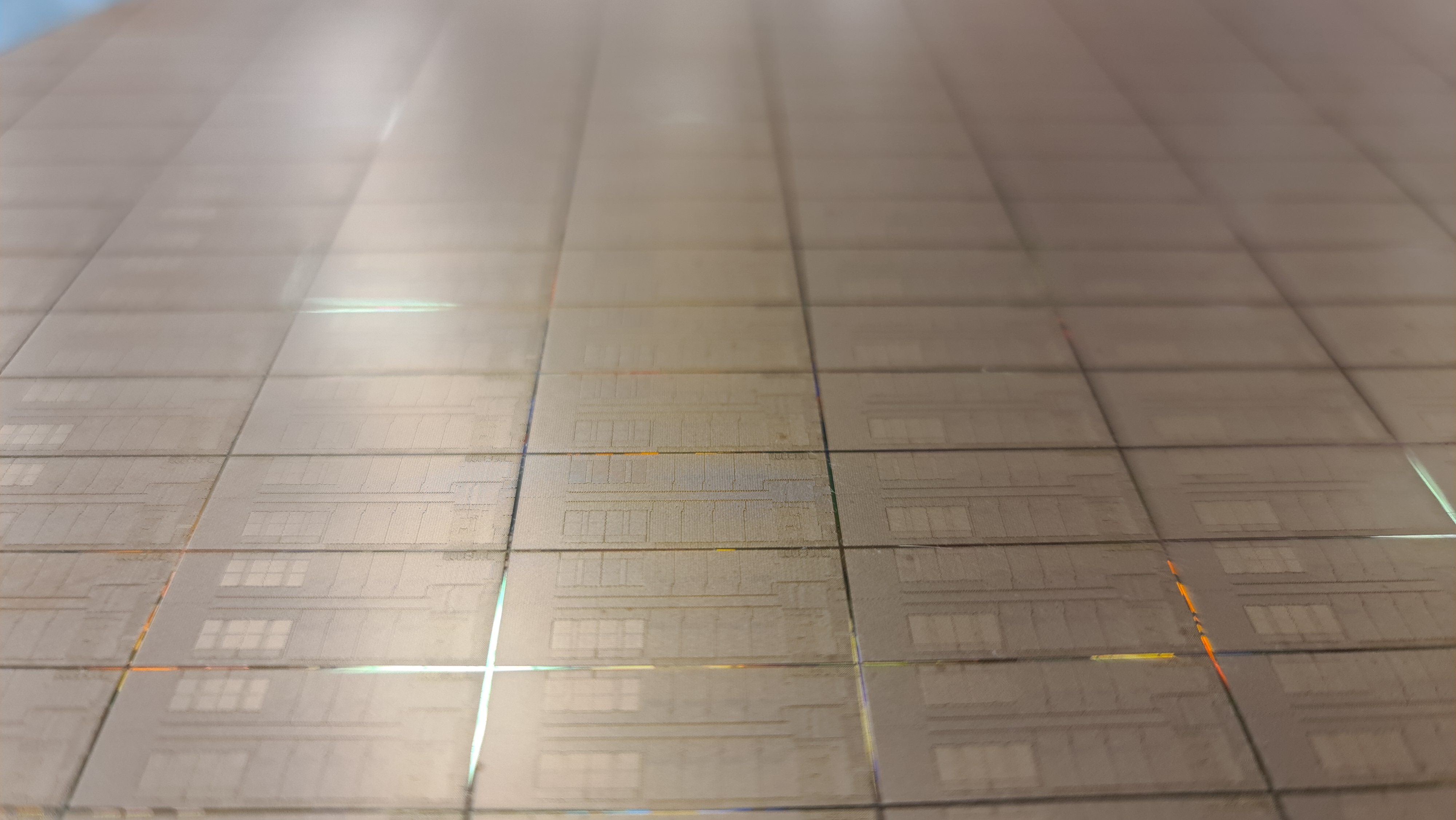

Altera had previously worked closely with Intel, having been acquired by the tech giant for $16.7 billion back in 2015. Under Intel’s ownership, Altera contributed significantly to Intel’s field-programmable gate array (FPGA) solutions.

The sale is anticipated to value Altera around $8.75 billion, an estimated decrease from its acquisition value. Despite selling this significant share, Intel will maintain a 49% stake in Altera, ensuring it can remain involved in the company’s strategic decisions.

The announcement of this change comes right after a leadership shakeup: Raghib Hussain, the former head of Products and Technologies at Marvell, has been appointed as Altera’s new CEO.

This transaction marks a substantial financial moment for Silver Lake, which manages over $104 billion in assets and has invested heavily in various technology sectors. With this move, Altera is set to become one of the most independently operated businesses within its niche, though Intel’s influence will still persist, given its retained share.